This is a very common question among not only expats, but also born and bred Parisians ! What is a bulletin de paie, how on earth does it work and how do salaries really work in France ? Most of all, WHAT do all these numbers mean ? Well Lodgis is here to help and to clean up the misunderstanding by explaining what a bulletin de paie is…

What is it?

The most important thing to note is that a fiche de paie is the same thing as a bulletin de salaire and a bulletin de paie. This is a piece of paper that you get when you receive your salary, which happens once a month in France, and it notifies you of how much of your salary will be paid to you, how much has gone to social security contributions and other taxes, how much money your employer has paid on your behalf and how much money you will owe in taxes at the end of the fiscal year. Most importantly, your fiche de paie explains the difference between your base salary (brut) and the amount of money you take home (net).

Salary

The work week in France is 35 hours. At the top of your bulletin de paie you should see your monthly salary broken down into how many hours you’ve worked and how much you are paid per hour. If you’ve worked any overtime, this will also appear here as something like « heures suppl. » and probably followed by 125 % because overtime hours are paid 25 % more than normal hours. However, it is also possible to work overtime and be paid in days off, rather than money. These days off are called RTT (rémuneration de temps de travail).

How much of your salary do you actually get?

This will depend on the statut of your job, which means what level you are as an employee, for example whether you’re an employé, an agent de maîtrise or a cadre. For an employé, the difference between your net and brut salary is about 21 %, whereas for a cadre it’s about 23 %.

Where is all my salary going??

This can be frustrating, as it can seem like you get far less of your salary than you were expecting. The 21%-23 % of your salary that you pay every months goes towards things like social security contributions, unemployment benefits, sick pay.

It’s also worth remembering that even though it’s frustrating to feel like so much of your salary is slipping through your fingers, your employer is paying even more. Each month you cost your employer 40-50 % more than what you take home.

If you look at your bulletin de paie, there should be four columns. Two on the left are called something like « taux » and « montant » and the other two on the right are called something like « charges patronales » and again divided into taux and montant. The section on the left indicates charges that the employee has to pay, whereas the section on the right indicated charges that the employer has to pay on behalf of the employee.

Any perks?

Your employer is obliged to reimburse 50 % of your public transport costs, although some companies will pay 100 % of your daily travel expenses. Some employers will also do this if your job requires you to be mobile and move around the city.

You should also get tickets restaurants, coupons that can be used to buy food at restaurants, bakeries and supermarkets. 50 % of the value of these coupons comes out of your salary and 50 % is contributed by your employer. You should get one of these every day that you work, with a value between 5 and 10 euros. It is up to the discretion of your employer to decide whether to give you tickets restaurants on days when you take a half day, are sick or work from home.

You can also get a primé d’ancienneté, a special bonus if you’ve been with your current employer for a long time. You may get more money per month if you’ve been at your current place of work for 5 years, for example, and this may well increase with time!

More taxes!

One very important thing that most people don’t know about their fiche de paie is that it shows you how much income tax you’ll need to pay ! If you look right at the bottom of your payslip, there should be a little table. Here you should have a column that says « Imposable », with two boxes saying «mois » and « cumul ». Here the mois part shows you how much income tax you should pay for each month when the time to pay your taxes rolls around, and cumul shows a running total as this number as it grows throughout the year. The amount of tax you have to pay each year is typically between 1 and 3 months salary ON TOP of the monthly taxes you pay (these are not income tax, but social security contributions for healthcare or unemployment).

Healthcare

If you’re receiving a payslip in France, then you’re definitely entitled to public healthcare to cover about 70 % of your healthcare expenses ! Read our article here to find out more ! In France it’s common to have top-up insurance, a mutuelle complémentaire, to cover the remaining 30 % of your healthcare expenses. Your employer is legally obligated to sign you up for their mutuelle. You can pay between 10-150 euros a month and also add your family for an extra cost.

Pension

Part of your salary automatically goes to your pension each month. How much you pay again depends on your statut and there are brackets for different sections. You contribute a certain amount, as does your employer.

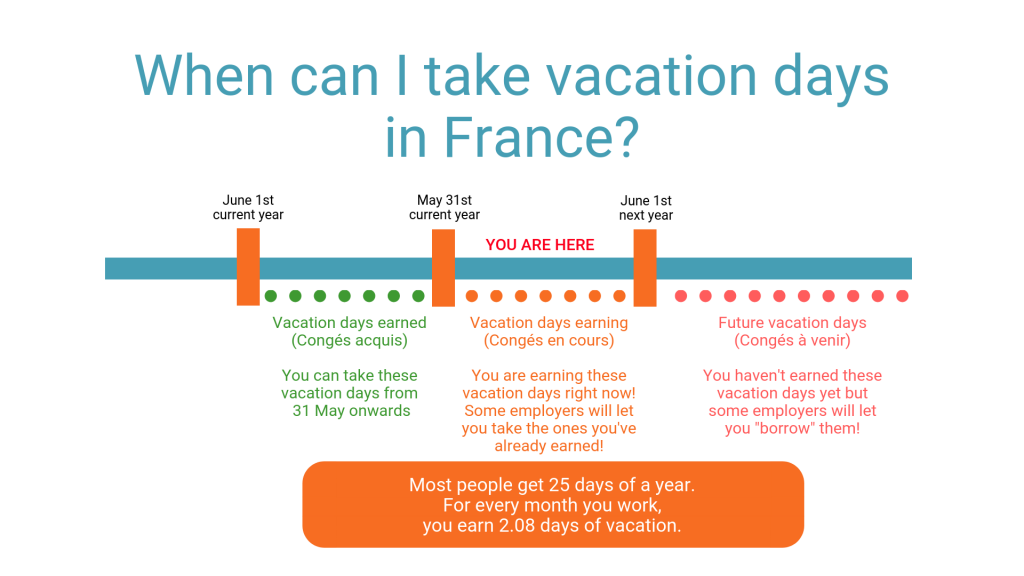

Vacation Days

Paid vacation days are called congés payés here in France. Most people get 25 days off a year (not including weekends or bank holidays). This is either calculated as 2.08 vacation days a month or 2.5 days a month (because this is for workers who wouldn’t get Saturdays off, so get 5 extra days of vacation to compensate).

As mentioned above, you can also earn vacation days by working overtime (over 35 hours a week). These are called RTT days and are accumulated throughout the calendar year. Make sure you use them all before the end of December or you’ll lose them!

Are you looking for an apartment in Paris?

Lodgis offers a fabulous selection of furnished apartments for rent. We offer over 7,500 properties, from studio to family apartments with period features, spacious dining and living areas, terraces, elevator access…and just about anything!

English

English Français

Français